percent change in working capital formula

The measure attempts to assess short term liquidity of a business and determine how well the company can cover the payment of its forthcoming liabilities. Calculation of percentage change in a profit can be done as follows-.

Working Capital Cycle Understanding The Working Capital Cycle

What is Working Capital.

. Percentage of Sales Method Formula Component of Working Capital 100 Sales of the Year. The working capital ratio also called the current ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with current assets. Convert that to a percentage by multiplying by 100 and adding a sign Note.

Net Working Capital Current Assets less cash Current Liabilities less debt or NWC Accounts Receivable Inventory Accounts Payable. When the new value is greater then the old value it is a percentage increase otherwise it is a decrease. Relevance and Uses of Percentage Change Formula.

For example to calculate the Monthly Change and Total Change. Invested Capital Total Short-Term Debt Total Long-Term Debt Total Lease Obligations Total Equity Non-Operating Cash. V 2 V 1 V 1 100.

The net working capital ratio measures the proportion of a businesss short-term net cash to its assets. Dollar amount of change Base year amount in working capital. We need to calculate Working Capital using Formula ie.

Thats because a companys current liabilities and current assets are based on a rolling 12-month period. Part 3 Changes in Net Working Capital. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

Invested Capital 2000000 1000000 500000 3000000 -3000000 Therefore the companys invested capital is 62 million. Current assets - current liabilities and expenses total assets You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow. The working capital ratio is important to creditors because it shows the liquidity of the company.

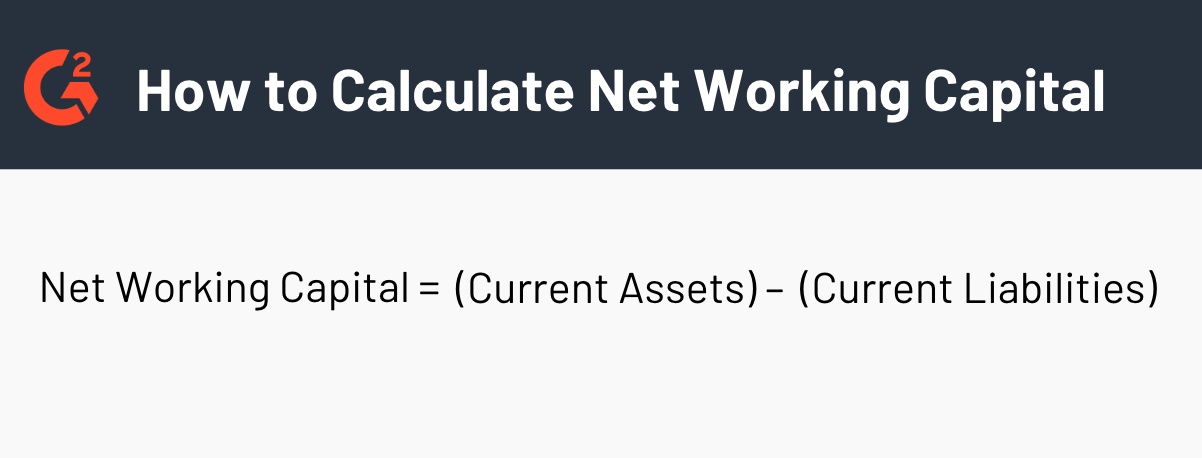

Working Capital Current Assets Current Liabilities. Divide that change by the old value you will get a decimal number Step 3. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period Change in Net Working Capital 12000 7000 Change in Net Working Capital 5000.

A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in the future through the current ratio which we get by dividing current assets by current liabilities. 175500-294944 175500 100. Percentage of Sales Method Example.

Consider following balance sheet for the year 2014 as an example. Working Capital Current Assets Current Liabilities. Percentage change equals the change in value divided by the absolute value of the original value multiplied by 100.

On the Home tab in the Number group apply a Percentage format. While working capital funds do not expire the working capital figure does change over time. It means the change in current assets minus the change in current liabilities.

The change in value is divided by the original value and then multiplied by 100. Current liabilities are best paid with current assets like cash cash equivalents and. Annualized net sales Accounts receivable Inventory - Accounts payable Management should be cognizant of the problems that can arise if it attempts to alter the outcome of this ratio.

Here are the various changes to working capital accounts Amazon experienced in 2017. Old Number Current Year Sale. Net Working Capital Total Current Assets Total Current Liabilities.

Change in working capital is a cash flow item that reflects the actual cash used to operate the business. Percentage change formula is large PercentageChangefracNewValue-OldValueOldValuetimes 100 If the result is positive then it is an increase. New number Previous Year Sale.

The sales for 2014 are 400. For example one how to calculate the percentage change. Calculate the change subtract old value from the new value Step 2.

Net Working Capital is Calculated using Formula. It is expressed in percentage it is the change in new value with respect to the old value. The working capital formula is.

Change in Working capital does mean actual change in value year over year ie. You can find the net working ratio with this simple calculation. The percent change formula is used very often in Excel.

Now we will calculate the change in profit. Percentage Change New Value Original Value Original Value 100. Finally the percentage change formula can be expressed as the change increase or decrease in value step 3 divided by its original value step 1 which is then multiplied by 100 as shown below.

To calculate a percentage increase first work out the difference increase between the two numbers you are comparing. The wrong way to do this is to calculate the working capital in year one from the balance sheet then calculate the working capital in year two from the balance sheet and then subtract to get the change. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling.

Inventory increased by 3583 million in the period which resulted in that amount of cash being deducted in the period since an increase in inventory is a. Next divide the increase by the original number and multiply the answer. Select cell C3 click on the lower right corner of cell C3 and drag it down to cell C13.

Select cell C3 and enter the formula shown below. Working capital is current assets less current liabilities and is often expressed as a percentage of sales in order to compare businesses within a sector. The sales to working capital ratio is calculated by dividing annualized net sales by average working capital.

Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. Percentage Change Δ V V 1 100. The first formula above is the broadest as it includes all accounts the second formula is more narrow and the last formula is the most narrow as it only includes three accounts.

What Is Net Working Capital How To Calculate Nwc Formula

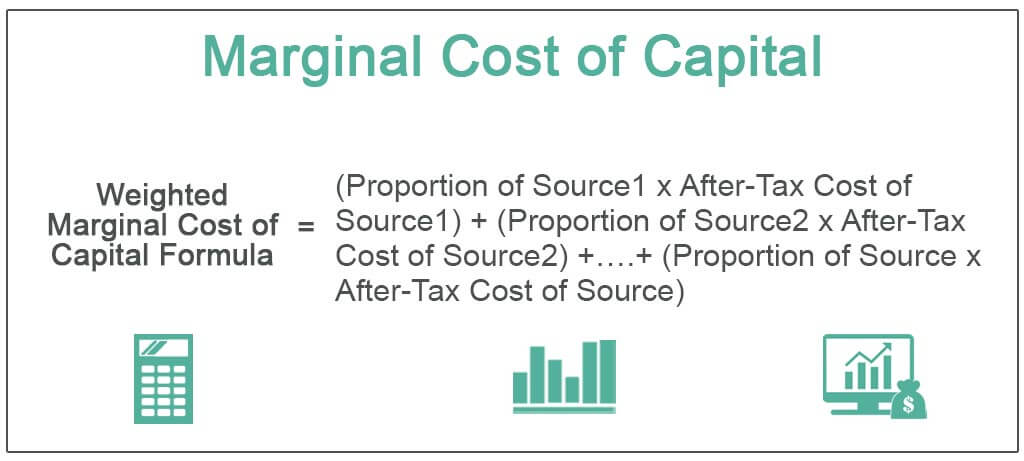

Marginal Cost Of Capital Definition Formula Calculation And Examples

Net Working Capital Formula Calculator Excel Template

Types Of Financial Statements Finance Investing Accounting And Finance Financial

Changes In Net Working Capital All You Need To Know

What Is Cagr And How It S Useful Finance Investing Financial Management Business Basics

Succession Planning Template Shrm 10 Things You Didn T Know About Succession Planning Templa Succession Planning Algebra Problems How To Plan

Ebit Vs Ebitda Differences Example And More Bookkeeping Business Accounting Education Financial Modeling

Working Capital Turnover Ratio Formula Calculator Excel Template

Analysis For The Investor Mgt537 Lecture In Hindi Urdu 20 Youtube In 2022 Financial Statement Investment Analysis Fundamental Analysis

Working Capital What It Is And How To Calculate It Efficy

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Meaning Formula Calculation

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Ratio Analysis Example Of Working Capital Ratio

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)